USAA, a financial services company with a storied history rooted in serving the military community, stands out in the car insurance market. Known for its competitive rates, personalized service, and unwavering commitment to those who serve, USAA has built a reputation as a trusted provider for military members, veterans, and their families. Navigating the world of car insurance can be daunting, but USAA’s dedication to simplifying the process and offering tailored solutions sets it apart.

This comprehensive guide explores the intricacies of obtaining a USAA car insurance quote, delving into the coverage options, pricing structure, and the unique benefits that make USAA a compelling choice for military-connected individuals. We’ll examine customer experiences, explore the claims process, and compare USAA’s offerings to those of its competitors. Ultimately, this guide aims to equip you with the knowledge and insights needed to make an informed decision about your car insurance needs.

USAA Overview

USAA, or the United Services Automobile Association, is a Fortune 500 financial services company with a long history of serving the unique needs of military members, veterans, and their families. Founded in 1922 by a group of Army officers, USAA has grown into a diversified financial services provider, offering a wide range of products and services, including insurance, banking, investments, and retirement planning.

USAA is known for its exceptional customer service, competitive rates, and commitment to its members. The company has consistently ranked high in customer satisfaction surveys and has received numerous awards for its financial products and services. USAA’s success can be attributed to its unwavering focus on its target audience and its commitment to providing personalized financial solutions tailored to the specific needs of military families.

USAA’s Mission and Target Audience

USAA’s mission is to “facilitate the financial security of its members, their families and those who serve.” The company’s target audience is primarily comprised of:

- Active-duty military personnel

- Veterans

- Their spouses

- Their dependents

USAA’s commitment to serving the military community is deeply ingrained in its culture and operations. The company has a long history of supporting military families through various initiatives, including financial education programs, scholarships, and disaster relief efforts.

USAA’s Reputation and Strengths

USAA’s reputation as a trusted and reliable financial services provider is built on several key strengths:

- Strong Financial Performance: USAA consistently delivers strong financial results, demonstrating its financial stability and ability to meet its members’ needs.

- Customer-Centric Approach: USAA prioritizes customer satisfaction and provides exceptional service to its members. This is reflected in its consistently high rankings in customer satisfaction surveys.

- Competitive Rates: USAA offers competitive rates on its financial products, making it an attractive option for military families seeking value.

- Wide Range of Products and Services: USAA provides a comprehensive suite of financial products and services, catering to the diverse needs of its members.

USAA’s Focus on Military Members

USAA’s focus on serving military members, veterans, and their families is evident in its:

- Specialized Products and Services: USAA offers products and services specifically tailored to the unique needs of military families, such as military-specific insurance policies and financial planning tools for military deployments.

- Dedicated Military Support: USAA provides dedicated support for military members, including resources for deployments, transitions to civilian life, and financial planning.

- Community Engagement: USAA actively engages with military communities through partnerships with military organizations and support for military-related causes.

Car Insurance Offerings

USAA offers a comprehensive suite of car insurance coverage options designed to meet the diverse needs of its members. The company’s approach emphasizes personalized coverage tailored to individual circumstances, ensuring that members are adequately protected while enjoying competitive rates and convenient services.

Coverage Options

USAA provides a variety of car insurance coverage options, each designed to address specific risks and financial liabilities. These options include:

- Liability Coverage: This essential coverage protects members against financial losses resulting from accidents they cause, covering bodily injury and property damage to others. It is typically required by law and comprises two key components: bodily injury liability and property damage liability.

- Collision Coverage: This coverage reimburses members for damages to their own vehicles caused by collisions with other vehicles or objects, regardless of fault. It covers repairs or replacement costs, minus the deductible.

- Comprehensive Coverage: This coverage protects members against damages to their vehicles caused by non-collision events, such as theft, vandalism, natural disasters, and animal collisions. It covers repairs or replacement costs, minus the deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects members against financial losses resulting from accidents caused by uninsured or underinsured drivers. It provides compensation for bodily injuries and property damage, up to the policy limits.

- Personal Injury Protection (PIP): This coverage, often required in certain states, provides medical and lost wage benefits to members and their passengers injured in accidents, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage provides medical expense coverage for members and their passengers, regardless of fault. It covers medical expenses incurred due to injuries in an accident, up to the policy limits.

- Rental Car Reimbursement: This coverage provides reimbursement for rental car expenses while the insured vehicle is being repaired or replaced after an accident.

- Roadside Assistance: This coverage provides assistance with various roadside emergencies, such as flat tires, jump starts, and towing services.

Pricing and Discounts

USAA’s car insurance rates are competitive and are determined by a number of factors, including the member’s driving history, vehicle type, location, and coverage choices. The company offers a wide range of discounts to help members save on their premiums. These discounts include:

- Good Driver Discount: Members with a clean driving record, free of accidents and traffic violations, can qualify for a significant discount on their premiums.

- Safe Driver Discount: Members who complete a defensive driving course can receive a discount on their premiums.

- Multi-Policy Discount: Members who bundle their car insurance with other USAA insurance products, such as home or renters insurance, can enjoy a discount on their premiums.

- Military Discounts: USAA offers special discounts to members of the military, recognizing their service and contributions.

- Vehicle Safety Features Discount: Members with vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control can receive a discount on their premiums.

Obtaining a Quote

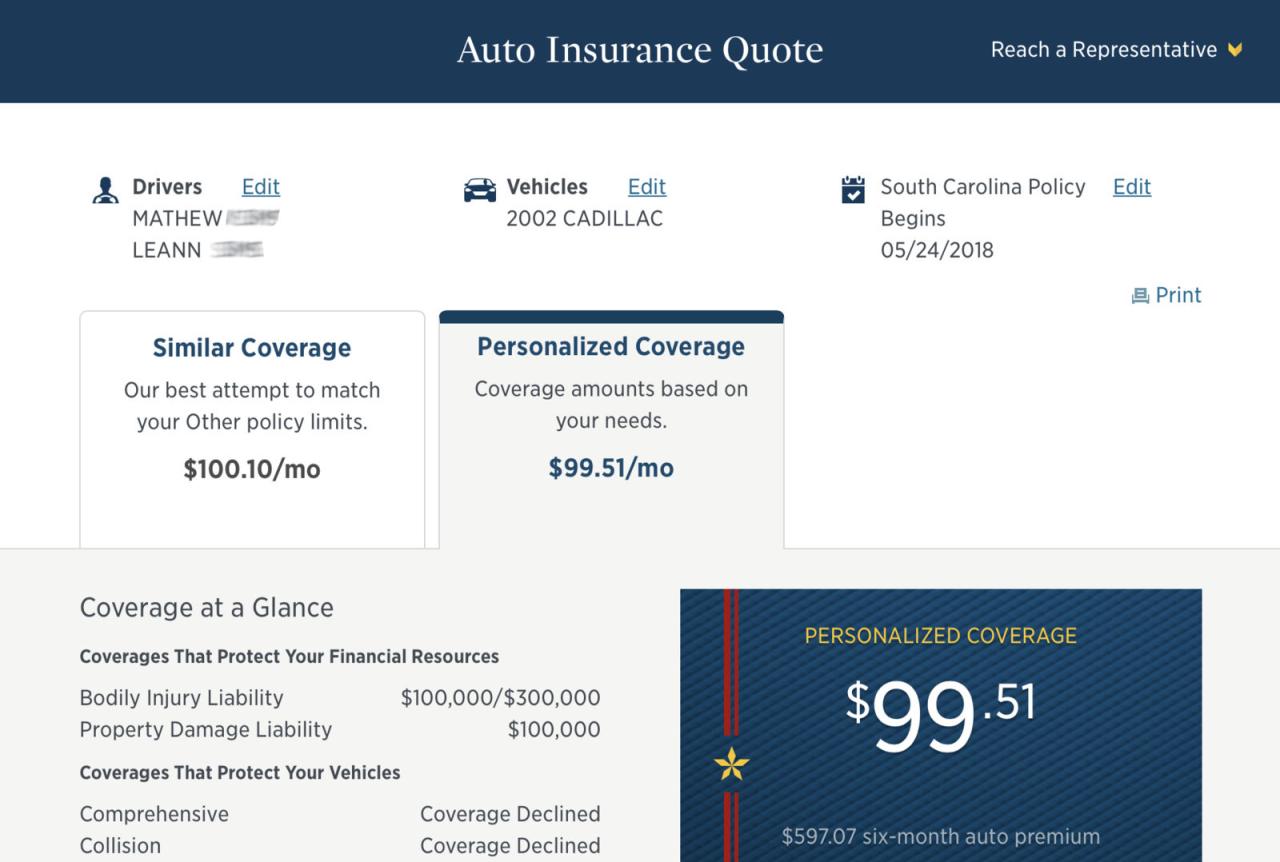

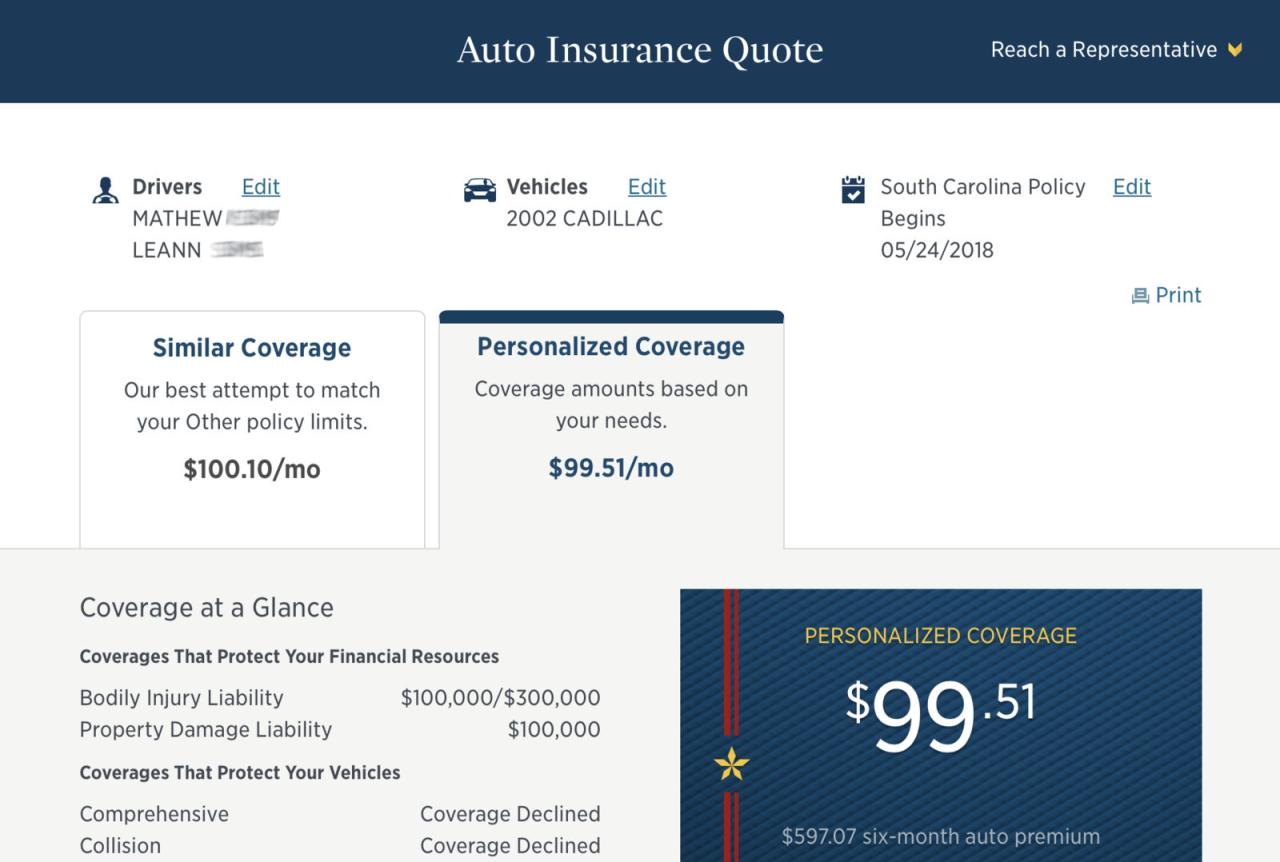

USAA offers various methods for obtaining a car insurance quote, catering to the diverse needs of its members. The process involves providing specific information about your vehicle, driving history, and other relevant details. This information helps USAA accurately assess your risk and generate a personalized quote.

Quote Request Methods

USAA provides several ways for members to request a car insurance quote:

- Online Quote Request: Members can conveniently obtain a quote online through USAA’s website. This method allows for quick and easy access to quote information.

- Phone Quote Request: Alternatively, members can contact USAA’s customer service representatives via phone to request a quote. This method offers personalized assistance and allows for clarification of any queries.

- Mobile App Quote Request: USAA’s mobile app also enables members to request a quote on the go. This option offers convenience and accessibility, allowing members to obtain quotes anytime, anywhere.

Information Required for a Quote

To generate an accurate car insurance quote, USAA requires members to provide the following information:

- Vehicle Details: This includes the year, make, model, and trim level of the vehicle.

- Vehicle Usage: Members need to specify how they primarily use the vehicle, such as for commuting, personal use, or business purposes.

- Driving History: USAA requires information about the member’s driving history, including any accidents, violations, or driving experience.

- Location: Members need to provide their address, as insurance premiums vary based on geographic location.

- Coverage Preferences: Members can choose their preferred coverage levels, such as liability, collision, and comprehensive coverage.

Comparing Quotes

Once members have received quotes from USAA, they can compare them with quotes from other insurance providers. This allows members to assess the various options available and choose the most suitable policy for their needs and budget.

“It’s important to compare quotes from multiple insurance providers to ensure you’re getting the best possible rates and coverage.”

When comparing quotes, members should consider factors such as:

- Premium Costs: Compare the monthly or annual premiums for each quote.

- Coverage Levels: Ensure that the coverage levels offered by each provider meet the member’s requirements.

- Deductibles: Compare the deductibles for different coverage options, as higher deductibles typically result in lower premiums.

- Discounts: Consider any available discounts, such as safe driver discounts, good student discounts, or multi-policy discounts.

- Customer Service: Research the reputation and customer service ratings of each insurance provider.

Customer Experience

USAA’s commitment to exceptional customer service is a cornerstone of its reputation. The company consistently receives high marks for its responsiveness, ease of use, and dedication to meeting the needs of its members. This dedication translates into a positive customer experience across all touchpoints.

Customer Reviews and Testimonials

Numerous customer reviews and testimonials highlight USAA’s strong commitment to providing a positive customer experience. Independent review sites like Trustpilot and Consumer Affairs consistently rank USAA highly for its car insurance services. Customers praise the company’s prompt claims processing, fair pricing, and personalized service.

“USAA has always been there for me. Their customer service is exceptional, and they go above and beyond to help their members. I’ve been with them for over 20 years and have never had a bad experience.” – John S., Trustpilot Review

“I recently had to file a claim after an accident, and USAA made the process so easy. They were incredibly responsive, and the claim was processed quickly and efficiently. I highly recommend USAA to anyone looking for car insurance.” – Sarah M., Consumer Affairs Review

Ease of Use and Accessibility of Online Platform and Mobile App

USAA’s online platform and mobile app are designed to be user-friendly and accessible. Members can easily manage their policies, pay their bills, and file claims online or through the app. The platform is intuitive and provides clear instructions and helpful resources.

- Online Platform: USAA’s website is well-organized and easy to navigate. Members can find information about their policies, make changes, and access their account history with ease.

- Mobile App: The USAA mobile app is highly rated for its convenience and functionality. Members can access all the features of the online platform through the app, including the ability to file claims, track their driving history, and get roadside assistance.

Quality and Responsiveness of Customer Support Channels

USAA offers a variety of customer support channels, including phone, email, and live chat. The company is known for its prompt and helpful customer service. Agents are knowledgeable and responsive, and they are available 24/7 to assist members with any questions or concerns.

- Phone Support: USAA’s phone support is available 24/7, and agents are typically able to resolve issues quickly and efficiently.

- Email Support: Members can contact USAA via email for non-urgent inquiries. The company typically responds to emails within 24 hours.

- Live Chat: USAA’s live chat feature allows members to get instant assistance with common questions and concerns.

Claims Process

USAA’s claims process is designed to be straightforward and customer-centric, aiming to provide a seamless experience for policyholders during a potentially stressful time. The company prioritizes prompt and fair claim resolution, offering various methods for reporting claims and providing support throughout the process.

Claim Filing Methods

USAA offers multiple ways to file a car insurance claim, catering to the diverse needs of its members. Policyholders can choose the method most convenient for them, ensuring a smooth and efficient process.

- Online Claim Filing: Members can submit their claims online through the USAA website or mobile app, allowing for quick and convenient reporting, 24/7 accessibility, and real-time claim status updates.

- Phone Claim Filing: USAA provides a dedicated phone line for claim reporting, enabling members to connect with a claims representative directly and receive immediate assistance. This option is particularly beneficial for individuals who prefer personal interaction or have complex claims.

- Mobile App Claim Filing: The USAA mobile app allows for easy and convenient claim filing, including the ability to upload photos and documents, track claim progress, and communicate with claims representatives directly.

Claim Handling Procedures

Once a claim is filed, USAA initiates a thorough investigation to determine the cause of the accident, assess damages, and evaluate coverage. The process involves several steps, ensuring fairness and accuracy in claim resolution.

- Initial Assessment: USAA reviews the claim details, including the accident report, policy coverage, and any supporting documentation, to determine the scope of the claim and assess initial liability.

- Damage Assessment: If necessary, USAA will arrange for an independent appraisal of the vehicle to determine the extent of damage and the cost of repairs. The company may also engage with repair shops to obtain estimates and ensure repairs are completed to industry standards.

- Liability Determination: USAA investigates the accident to determine fault and liability, taking into account factors such as driver negligence, traffic laws, and witness statements. This process may involve reviewing police reports, conducting interviews, or obtaining expert opinions.

- Claim Resolution: Based on the investigation findings, USAA will determine the coverage applicable to the claim and proceed with payment or denial. If the claim is approved, USAA will work with the policyholder to coordinate repairs or replacement, providing guidance and support throughout the process.

Claim Resolution Timelines

USAA aims to resolve claims promptly and fairly, providing clear communication and updates throughout the process. The time it takes to resolve a claim can vary depending on the complexity of the situation, but USAA strives to provide a reasonable timeframe.

- Simple Claims: For straightforward claims with minimal damage and clear liability, USAA may be able to resolve the claim within a few days or weeks.

- Complex Claims: For claims involving significant damage, multiple parties, or disputes over liability, the resolution process may take longer, potentially extending to several weeks or months.

Customer Satisfaction

USAA places a high value on customer satisfaction, aiming to provide a positive and supportive claims experience. The company employs various strategies to ensure customer satisfaction, including:

- Dedicated Claims Representatives: USAA assigns dedicated claims representatives to each policyholder, providing a single point of contact for all claim-related inquiries and ensuring consistent communication throughout the process.

- 24/7 Accessibility: USAA offers 24/7 access to claims support through phone, online, and mobile app channels, ensuring members can receive assistance whenever needed.

- Transparent Communication: USAA provides clear and timely updates on claim progress, keeping policyholders informed about the status of their claim and any actions taken.

- Fair and Equitable Resolution: USAA strives to resolve claims fairly and equitably, considering all relevant factors and ensuring that policyholders receive the coverage they are entitled to.

Comparison to Competitors

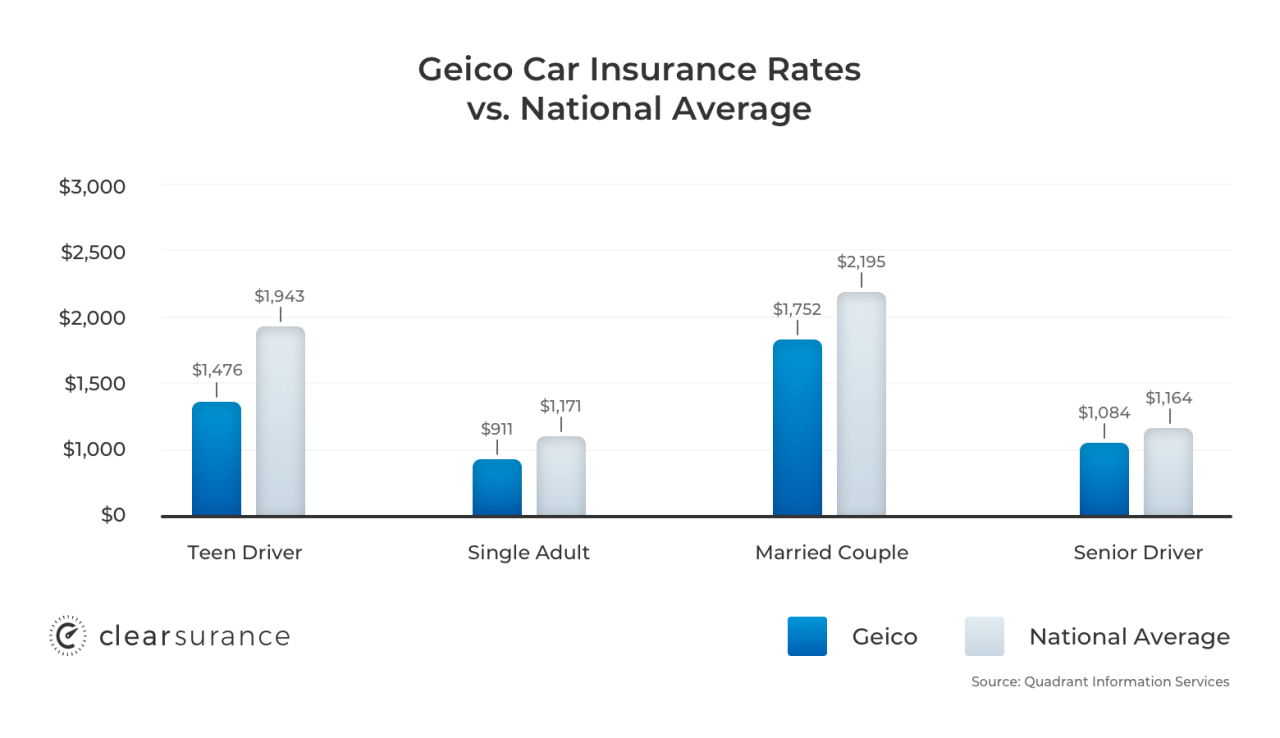

USAA’s car insurance offerings stand out in the competitive landscape, attracting a loyal customer base, particularly among military families and veterans. However, comparing its offerings to those of other major insurance providers reveals both strengths and weaknesses, and it’s crucial to consider these factors when evaluating USAA’s overall value proposition.

Strengths and Weaknesses

USAA’s strengths lie in its dedication to serving the military community, its competitive pricing, and its excellent customer service. Its weaknesses include its limited availability and its potential for higher premiums for certain demographics.

- Strengths

- Exclusive Focus on Military Families: USAA’s commitment to serving military families sets it apart from other insurance providers. This focus translates into tailored products and services that cater to the unique needs of active-duty personnel, veterans, and their families.

- Competitive Pricing: USAA is known for offering competitive car insurance rates, particularly for members who maintain good driving records. Its pricing structure often reflects its dedication to serving its target audience.

- Excellent Customer Service: USAA consistently ranks high in customer satisfaction surveys, reflecting its commitment to providing responsive and personalized service. Its customer service representatives are highly trained and knowledgeable, ensuring a positive experience for policyholders.

- Weaknesses

- Limited Availability: USAA’s car insurance is only available to current or former members of the U.S. military and their families. This exclusivity limits its reach and may not be suitable for individuals outside this demographic.

- Potential for Higher Premiums: While USAA offers competitive pricing overall, some demographics, such as younger drivers or those with a history of accidents, may face higher premiums compared to other insurers.

Key Differentiators

USAA’s unique selling proposition lies in its unwavering commitment to serving the military community. This dedication translates into various key differentiators:

- Military-Specific Benefits: USAA offers unique benefits tailored to the needs of military personnel, such as discounts for deployments and military-specific coverage options.

- Strong Brand Loyalty: USAA enjoys a high level of brand loyalty among its members, driven by its history of providing exceptional service and support to military families. This loyalty translates into a dedicated customer base and positive word-of-mouth marketing.

- Focus on Financial Stability: USAA’s financial stability is a significant differentiator, instilling confidence in its ability to meet its obligations to policyholders. Its strong financial position allows it to weather market fluctuations and provide reliable insurance coverage.

Comparison to Other Major Providers

When comparing USAA to other major insurance providers, it’s crucial to consider factors like coverage options, pricing, customer service, and availability.

- Geico: Geico is known for its competitive pricing and easy online quoting process. It offers a wide range of coverage options and has a strong online presence.

- Progressive: Progressive stands out for its personalized pricing options, including its “Name Your Price” tool. It also offers a wide array of coverage options and has a strong focus on customer service.

- State Farm: State Farm is a well-established insurer with a strong reputation for customer service and financial stability. It offers a wide range of insurance products, including car insurance, and has a strong local presence.

- Allstate: Allstate is another well-known insurer with a wide range of coverage options and a strong focus on customer service. It offers various discounts and has a strong online presence.

Financial Stability and Ratings

When choosing an insurance provider, it’s crucial to consider their financial stability. A financially sound insurer is more likely to be able to pay claims in the event of a major disaster or economic downturn. This is where credit ratings come into play, providing insights into an insurer’s financial health.

USAA’s Financial Strength

USAA has consistently demonstrated strong financial stability, earning high credit ratings from leading agencies. These ratings reflect USAA’s robust capital position, sound investment strategies, and prudent risk management practices.

- A.M. Best: A+ (Superior), a testament to USAA’s exceptional financial strength, operating performance, and business profile.

- Standard & Poor’s: A+, reflecting USAA’s strong capitalization, excellent operating performance, and sound risk management practices.

- Moody’s: Aa2, indicating USAA’s very high financial strength and low credit risk.

“USAA’s strong financial strength is a key factor in its ability to provide reliable and secure insurance coverage to its members.”

USAA’s Commitment to Military Service

USAA, originally known as the United Services Automobile Association, was founded in 1922 by a group of Army officers who wanted to provide insurance for fellow service members. Since then, the company has become a leading financial services provider for military personnel, veterans, and their families.

USAA’s mission statement is to “facilitate the financial security of its members, their families, and those who serve.” This commitment to military service is evident in the numerous programs and initiatives that the company offers to support the military community.

Programs and Initiatives

USAA’s dedication to serving the military community is reflected in the wide range of programs and initiatives it offers. These include:

- Military Spouse Employment Program: This program helps military spouses find jobs and build careers, providing them with resources and support during transitions and deployments. The program offers workshops, career counseling, and job placement services, empowering spouses to thrive in their careers despite the unique challenges associated with military life.

- USAA Foundation: The USAA Foundation is a non-profit organization dedicated to supporting military families and communities. The foundation provides grants and resources to organizations that focus on military education, housing, and financial literacy.

- USAA Military Appreciation Days: USAA hosts various events and activities throughout the year to honor and celebrate the contributions of military personnel and their families. These events often include discounts, giveaways, and opportunities for members to connect with one another.

- Military Discounts: USAA offers exclusive discounts on its products and services to active duty military personnel, veterans, and their families. These discounts are a tangible way for the company to express its gratitude and support for the military community.

Impact on Car Insurance Offerings

USAA’s commitment to military service extends to its car insurance offerings. The company understands the unique needs of military members and their families, and its car insurance policies are designed to address these needs. For instance:

- Deployment Coverage: USAA offers coverage for vehicles that are left behind during deployments. This ensures that members can have peace of mind knowing that their vehicles are protected while they are away serving their country.

- Military Base Coverage: USAA provides comprehensive insurance coverage for vehicles that are driven on military bases, including coverage for accidents that occur on base.

- Military Spouse Discounts: USAA offers discounts to military spouses, recognizing the unique challenges they face in managing household finances while their partners are deployed.

Technological Advancements

USAA has embraced technology to modernize its car insurance offerings and enhance the customer experience. From telematics programs to mobile app features, the company leverages various technological tools to deliver a seamless and personalized insurance experience.

Telematics

Telematics programs, such as USAA’s Drive Safe & Save, utilize telematics devices or smartphone apps to track driving behavior. This data can be used to identify safe driving habits and reward policyholders with discounts.

- Data Collection: Telematics devices or apps track driving behavior, such as speed, braking, and acceleration, providing valuable insights into driving habits.

- Discount Opportunities: Safe driving behavior, as measured by telematics data, can qualify policyholders for discounts on their premiums.

- Personalized Feedback: Drivers receive personalized feedback on their driving habits, allowing them to identify areas for improvement and potentially enhance their safety.

Online Policy Management

USAA provides a comprehensive online platform for policy management, allowing policyholders to access and manage their policies, make payments, and submit claims conveniently.

- Policy Access: Policyholders can access their policy details, including coverage information, payment history, and claim records, anytime and anywhere.

- Payment Options: Online payment options provide flexibility and convenience for policyholders, enabling them to make payments according to their schedule.

- Claim Reporting: The online platform facilitates efficient claim reporting, allowing policyholders to submit claims with ease and track their progress.

Mobile App Functionalities

USAA’s mobile app offers a range of features designed to enhance the customer experience and provide on-the-go access to insurance services.

- Policy Management: The app allows policyholders to manage their policies, view coverage details, and make payments.

- Claim Reporting: Policyholders can report claims, upload photos, and track their progress directly through the app.

- Roadside Assistance: The app provides access to roadside assistance services, including towing and flat tire assistance.

- Digital ID Cards: Policyholders can access and display digital copies of their insurance cards through the app.

Future Trends in Car Insurance

The car insurance industry is poised for significant transformation driven by technological advancements and evolving consumer preferences. The rise of autonomous vehicles, connected cars, and data-driven insights is shaping the landscape, presenting both opportunities and challenges for insurers like USAA.

Impact of Emerging Technologies

The emergence of autonomous vehicles (AVs) and connected cars is fundamentally altering the car insurance landscape. AVs, with their advanced safety features and potential to reduce accidents, are expected to significantly impact traditional risk models. Connected cars, equipped with sensors and telematics systems, provide insurers with valuable data on driving behavior, vehicle condition, and environmental factors. This data can be used to personalize premiums, optimize risk assessment, and develop innovative insurance products.

Opportunities for USAA

USAA, with its strong focus on technology and customer service, is well-positioned to capitalize on the opportunities presented by these emerging trends. The company can leverage its existing data analytics capabilities to develop sophisticated risk models that account for the unique characteristics of AVs and connected cars. This could lead to the creation of tailored insurance products that offer competitive pricing and comprehensive coverage.

- Personalized Pricing: USAA can utilize telematics data to offer personalized premiums based on individual driving behavior and risk profiles. This data-driven approach can lead to more equitable pricing and potentially lower premiums for safe drivers.

- Usage-Based Insurance: The company can implement pay-per-mile or pay-as-you-drive insurance models that adjust premiums based on actual driving patterns. This approach can be particularly attractive to drivers who use their vehicles less frequently.

- Predictive Maintenance: USAA can leverage connected car data to provide predictive maintenance services, alerting drivers to potential issues before they become major problems. This can help reduce accidents and claims, leading to lower premiums for policyholders.

Challenges for USAA

While these emerging technologies present exciting opportunities, they also pose significant challenges.

- Data Privacy and Security: USAA will need to address concerns regarding data privacy and security as it collects and analyzes data from connected cars. Robust security measures and transparent data usage policies are crucial to maintain customer trust.

- Liability and Regulation: The legal and regulatory landscape surrounding AVs is still evolving. USAA will need to adapt its policies and procedures to comply with new regulations and address issues related to liability in the event of accidents involving AVs.

- Adapting to New Risk Models: Traditional risk models may not accurately reflect the risks associated with AVs and connected cars. USAA will need to develop new risk models that incorporate the unique characteristics of these technologies.

Concluding Remarks

USAA’s commitment to serving the military community shines through in its car insurance offerings. From its competitive rates and comprehensive coverage options to its seamless online platform and dedicated customer support, USAA prioritizes providing a positive and efficient experience. If you are a military member, veteran, or family member, USAA deserves serious consideration as your car insurance provider. By understanding the nuances of USAA’s offerings, you can confidently navigate the process of obtaining a quote and securing the coverage that best meets your needs.