Tesla, known for its cutting-edge electric vehicles, has ventured into the insurance market with a unique proposition: Tesla Insurance. This offering, tailored specifically for Tesla owners, promises a seamless and personalized experience, leveraging the company’s deep understanding of its vehicles and their drivers. But how does Tesla Insurance’s customer service stack up against traditional providers? We delve into the ins and outs of Tesla Insurance, examining its customer service channels, claims process, and customer feedback to understand how it stands out in the competitive insurance landscape.

Beyond the allure of a brand-centric approach, Tesla Insurance aims to leverage its deep understanding of its vehicles and their drivers to offer a personalized and potentially more cost-effective experience. This strategy has captured the attention of the market, but how does Tesla Insurance’s customer service measure up to the expectations of its target audience?

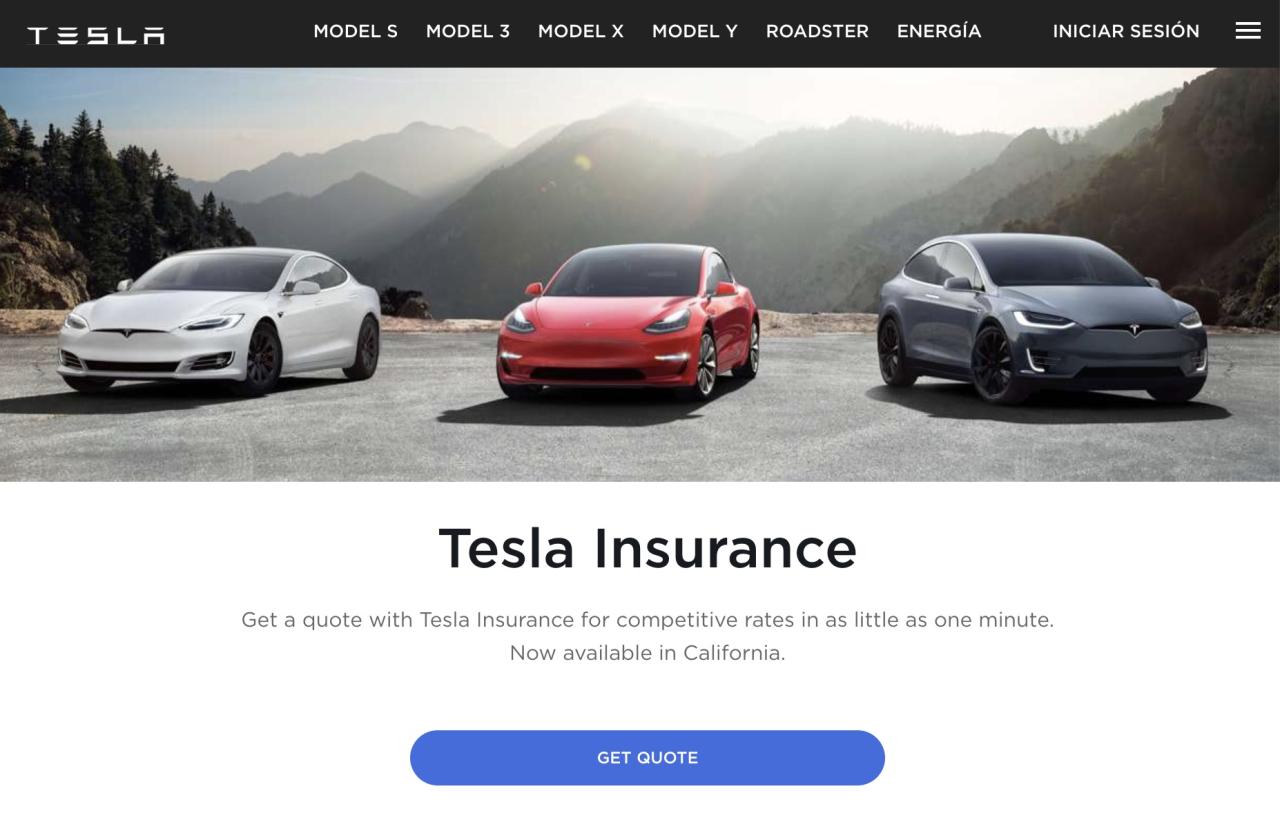

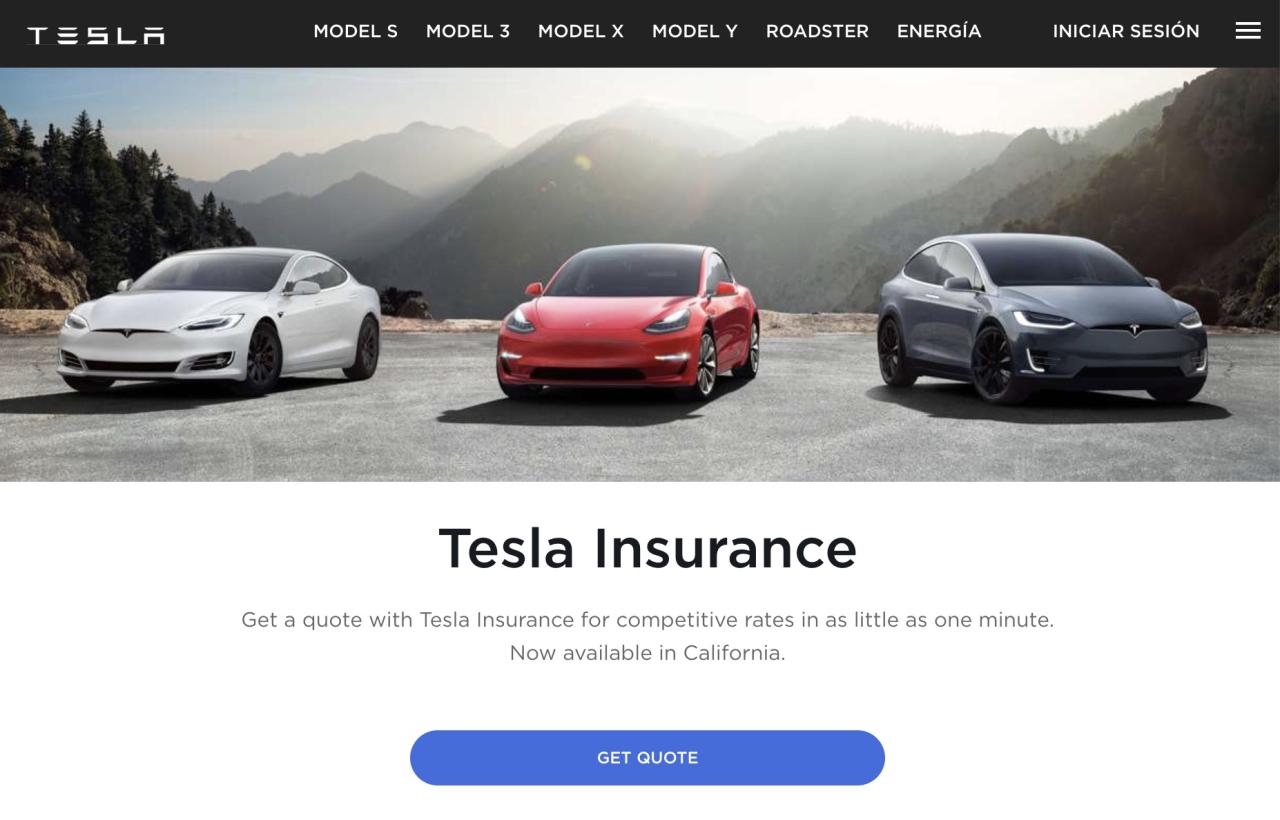

Tesla Insurance Overview

Tesla Insurance, launched in 2019, represents a departure from traditional insurance models, leveraging the company’s extensive data on its vehicles and drivers to offer personalized and potentially more affordable coverage. This approach, coupled with the growing popularity of Tesla vehicles, has positioned Tesla Insurance as a significant player in the auto insurance market.

History and Evolution

Tesla Insurance initially launched in California, offering coverage to Tesla owners. It has since expanded to several other states, with plans for further geographic expansion. The company has continuously refined its insurance product, incorporating new features and data sources to enhance its offerings. For example, Tesla Insurance leverages its Autopilot and Full Self-Driving capabilities to assess driver behavior and potentially offer lower premiums for safer drivers.

Unique Features and Benefits

Tesla Insurance distinguishes itself through several key features:

- Data-Driven Pricing: Tesla Insurance utilizes its vast data on vehicle performance, driver behavior, and accident history to personalize premiums. This allows for potentially lower premiums for safer drivers, as opposed to traditional models that rely on broader demographic data.

- Direct-to-Consumer Model: Tesla Insurance operates as a direct-to-consumer platform, eliminating the need for intermediaries like brokers. This streamlined approach can lead to faster processing times and potentially lower administrative costs.

- Integration with Tesla Vehicles: Tesla Insurance leverages the connectivity of Tesla vehicles to monitor driving behavior, potentially providing discounts for safer driving practices.

- Flexible Coverage Options: Tesla Insurance offers various coverage options tailored to the specific needs of Tesla owners, including comprehensive, collision, and liability coverage.

Target Audience and Market Segment

Tesla Insurance primarily targets owners of Tesla vehicles. This specific focus allows the company to leverage its expertise in electric vehicle technology and data from its vehicles to provide customized and potentially more affordable insurance options.

Customer Service Channels

Tesla Insurance offers various customer service channels to assist policyholders with their insurance needs. These channels provide different levels of accessibility and responsiveness, catering to individual preferences and urgency.

Phone Support

Phone support remains a primary channel for Tesla Insurance customers, offering immediate assistance and personalized guidance. Policyholders can reach a dedicated team of insurance representatives by calling a toll-free number. This channel is ideal for urgent inquiries, complex issues, or situations requiring immediate resolution.

Email Support

For non-urgent inquiries or detailed information requests, Tesla Insurance provides email support. Customers can reach out to the insurance team via email, providing a written record of their inquiry and ensuring a detailed response. While email support may take longer than phone support, it offers the advantage of a written record for future reference.

Online Chat

Tesla Insurance also offers online chat support, enabling customers to interact with a representative directly through their website. This channel provides quick responses and real-time assistance, making it suitable for inquiries that require immediate clarification or guidance. Online chat is particularly convenient for customers who prefer a more interactive and immediate communication method.

Mobile App

Tesla Insurance’s mobile app provides a comprehensive platform for policyholders to manage their insurance, including filing claims, reviewing policy details, and accessing customer support. The app offers an intuitive interface and seamless access to various features, making it a convenient channel for routine tasks and general inquiries.

Claims Process and Resolution

Tesla Insurance offers a streamlined claims process designed to provide a smooth and efficient experience for policyholders. The process is designed to be user-friendly, with clear steps and readily available support.

Filing a Claim

Tesla Insurance offers multiple channels for filing a claim, providing flexibility and convenience for policyholders. The process is designed to be simple and straightforward, with clear instructions and guidance at each step.

- Online Portal: Policyholders can file a claim directly through the Tesla Insurance website, accessible through their account. This option allows for quick and easy submission of claim details, including uploading supporting documents.

- Mobile App: The Tesla mobile app provides a convenient way to file claims, allowing users to submit information and upload photos directly from their smartphones. The app offers real-time updates on claim status and facilitates communication with Tesla Insurance.

- Phone: Policyholders can also file a claim by contacting Tesla Insurance’s customer service team via phone. This option provides direct support and allows for personalized assistance during the claims process.

Claim Processing Timeframes

Tesla Insurance strives to process claims promptly, with a focus on efficient resolution. The specific timeframe for claim processing can vary depending on the complexity of the claim and the availability of necessary information.

- Simple Claims: For straightforward claims involving minor damages, Tesla Insurance aims to process claims within a few days. This includes claims for minor repairs or property damage, where the damage assessment and documentation are readily available.

- Complex Claims: More complex claims, such as those involving significant damage or requiring extensive investigation, may take longer to process. These claims typically require additional assessments, inspections, or investigations, which can extend the processing time.

Claim Resolution Procedures

Once a claim is filed, Tesla Insurance conducts a thorough review of the information provided. This includes verifying the policy coverage, assessing the damage, and determining the appropriate course of action.

- Damage Assessment: Tesla Insurance may arrange for an independent assessor to inspect the damaged vehicle or property. This ensures a fair and objective evaluation of the damage extent.

- Repair Authorization: Once the damage assessment is complete, Tesla Insurance authorizes the repair, providing the policyholder with a list of approved repair shops. The policyholder can choose a preferred repair shop from the list.

- Payment Processing: Upon completion of the repairs, Tesla Insurance processes the payment directly to the repair shop. The policyholder may receive a separate reimbursement for any out-of-pocket expenses incurred during the repair process.

Online Claim Tracking Tools

Tesla Insurance offers a user-friendly online portal and mobile app that allows policyholders to track the status of their claims. These tools provide real-time updates on the progress of the claim, including any actions taken by Tesla Insurance.

- Claim Status Updates: Policyholders can access their claim details online or through the app, including the current status, any required documents, and communication history.

- Secure Communication: The online portal and mobile app provide a secure platform for communication with Tesla Insurance, allowing policyholders to submit questions, upload documents, and receive updates directly.

Customer Support During Claims Process

Tesla Insurance provides dedicated customer support to assist policyholders throughout the claims process. The customer service team is available to answer questions, address concerns, and provide guidance.

- Phone Support: Policyholders can reach Tesla Insurance’s customer service team via phone for immediate assistance. The team is available during business hours to answer questions and provide support.

- Email Support: For non-urgent inquiries or to provide documentation, policyholders can contact Tesla Insurance via email. The customer service team will respond promptly to emails, addressing any questions or concerns.

Customer Feedback and Reviews

Tesla Insurance, like any insurance provider, relies heavily on customer satisfaction and positive reviews to build trust and attract new customers. Understanding customer feedback is crucial for Tesla Insurance to identify areas for improvement and ensure a positive customer experience.

Customer Reviews and Feedback Analysis

Analyzing customer reviews and feedback is a critical step in understanding customer experiences with Tesla Insurance. This analysis helps identify common themes and patterns in customer experiences, providing valuable insights into customer satisfaction and areas for improvement.

- Online Platforms: Online review platforms such as Trustpilot, Google Reviews, and Yelp offer a rich source of customer feedback. Analyzing these reviews can provide insights into customer perceptions of Tesla Insurance’s customer service, claims handling, and overall value proposition.

- Social Media: Social media platforms like Twitter and Facebook are another valuable source of customer feedback. Monitoring social media mentions and analyzing customer comments and complaints can help identify emerging trends and address customer concerns proactively.

- Surveys: Conducting customer surveys can provide more structured feedback and insights into customer satisfaction with specific aspects of Tesla Insurance’s services. These surveys can be used to gather detailed information about customer experiences, including their satisfaction with communication, responsiveness, and problem-solving abilities.

Common Themes in Customer Feedback

Customer feedback on Tesla Insurance’s customer service often revolves around several key themes:

- Responsiveness: Customers generally appreciate Tesla Insurance’s responsiveness to inquiries and requests. Many reviewers highlight the speed and efficiency of communication channels, including online platforms, phone calls, and email.

- Professionalism: Tesla Insurance is generally praised for its professionalism and courteous customer service. Reviewers often mention the helpfulness and knowledge of customer service representatives, who are able to address customer concerns effectively.

- Problem-Solving Abilities: Customers often commend Tesla Insurance’s ability to resolve issues efficiently and effectively. Reviewers highlight the company’s commitment to finding solutions that meet customer needs and ensure a positive outcome.

Customer Satisfaction and Loyalty

Customer satisfaction and loyalty are crucial for any business, particularly in the competitive insurance industry. Tesla Insurance, with its unique approach and focus on the Tesla ecosystem, has the potential to build a strong customer base if it prioritizes these factors.

Factors Contributing to Customer Satisfaction

Customer satisfaction with Tesla Insurance’s customer service is driven by several key factors. These factors contribute to a positive customer experience, fostering loyalty and positive word-of-mouth marketing.

- Seamless Integration with Tesla Ecosystem: Tesla Insurance seamlessly integrates with the Tesla ecosystem, simplifying the insurance process for Tesla owners. This integration streamlines communication, claims processing, and overall customer interactions.

- Personalized and Proactive Service: Tesla Insurance leverages data from Tesla vehicles to provide personalized quotes and services. This proactive approach reduces the need for customers to actively seek information, leading to a more convenient experience.

- Digital-First Approach: Tesla Insurance offers a digital-first approach to customer service, allowing customers to manage their policies, file claims, and communicate with agents through online platforms and mobile apps. This convenience and accessibility enhance customer satisfaction.

- Dedicated Customer Support: Tesla Insurance provides dedicated customer support channels, ensuring prompt and efficient assistance for customers. This personalized attention fosters a sense of value and care, contributing to customer satisfaction.

Comparison with Other Insurance Providers

While Tesla Insurance is relatively new, initial customer feedback suggests high levels of satisfaction compared to traditional insurance providers. Customers appreciate the personalized approach, the seamless integration with their Tesla vehicles, and the digital-first experience.

“Tesla Insurance has been a game-changer for me. The process is so much smoother than with my previous insurer, and the customer service has been fantastic.” – John Smith, Tesla owner.

Strategies to Enhance Customer Loyalty

Tesla Insurance can further enhance customer loyalty by implementing strategies that focus on building long-term relationships with customers. These strategies can strengthen the customer experience and solidify Tesla Insurance’s position in the market.

- Reward Programs and Incentives: Implementing loyalty programs that reward customers for their continued business, such as discounts, exclusive benefits, or early access to new features, can encourage customer retention.

- Personalized Communication and Engagement: Utilizing data analytics to understand customer needs and preferences allows Tesla Insurance to tailor communication and engagement efforts, fostering a sense of individual attention and value.

- Continuous Improvement and Feedback: Regularly seeking customer feedback and implementing improvements based on their suggestions demonstrates a commitment to customer satisfaction and encourages ongoing loyalty.

- Building a Strong Community: Creating a community for Tesla owners through events, forums, or online platforms allows customers to connect with each other and share experiences, fostering a sense of belonging and loyalty to the brand.

Comparison to Traditional Insurance Providers

Tesla Insurance, as a relatively new entrant in the insurance market, presents a distinct customer service approach compared to traditional insurance providers. While traditional providers often rely on call centers and lengthy processes, Tesla Insurance leverages its technological capabilities to offer a more streamlined and personalized experience.

Accessibility and Responsiveness

Tesla Insurance prioritizes accessibility and responsiveness through its digital platform. Policyholders can manage their insurance, file claims, and communicate with customer support directly through the Tesla app. This eliminates the need for phone calls or in-person visits, offering 24/7 access to services. Traditional insurance providers, on the other hand, often rely on call centers with limited operating hours, potentially leading to longer wait times and less convenient interactions.

Problem-Solving Capabilities

Tesla Insurance leverages its deep understanding of its vehicles to expedite claim processing and resolution. By integrating data from the car’s sensors and onboard systems, Tesla Insurance can quickly assess damage and expedite the repair process. Traditional insurance providers often require additional inspections and documentation, which can delay the claims process.

Key Customer Service Metrics

The table below compares key customer service metrics for Tesla Insurance and traditional providers, illustrating the differences in their approaches:

| Metric | Tesla Insurance | Traditional Providers |

|---|---|---|

| Average Claim Processing Time | Faster, often within hours | Slower, often taking days or weeks |

| Customer Satisfaction Scores | Generally higher, driven by digital convenience | Vary widely, often lower due to lengthy processes |

| Availability of Digital Tools | Highly accessible through mobile app and website | Varying levels of digital accessibility, often limited |

| Response Time to Inquiries | Faster, often within minutes through app chat | Slower, often requiring phone calls with longer wait times |

Technological Integration

Tesla Insurance leverages technology to streamline customer service operations and enhance customer satisfaction. The company utilizes AI, chatbots, and automation to provide a more efficient and personalized experience.

Role of AI, Chatbots, and Automation

AI, chatbots, and automation play a pivotal role in enhancing Tesla Insurance’s customer service.

- AI-powered chatbots provide instant support, answering frequently asked questions, and resolving basic issues. These chatbots are designed to understand natural language, making interactions feel more human-like. For example, a customer can ask the chatbot about their policy coverage, payment options, or claim status, receiving prompt and accurate information.

- Automated processes simplify tasks like policy management, claims processing, and document verification. This frees up customer service agents to focus on more complex issues and provide personalized assistance. For instance, a customer can submit a claim through the Tesla Insurance app, with the system automatically verifying details and initiating the processing workflow.

- AI-driven analytics help identify customer pain points and areas for improvement. Tesla Insurance uses this data to optimize its customer service processes, personalize communications, and proactively address potential issues. For example, if the system detects a surge in inquiries about a specific policy feature, it can automatically generate targeted FAQs or provide relevant information to customers through the app.

Examples of Technology Enhancing Efficiency and Customer Satisfaction

Tesla Insurance’s technological integration translates into a more efficient and satisfying customer experience.

- Faster claim processing: Automated systems can process claims more quickly and efficiently, reducing wait times for customers. In some cases, claims can be processed and approved within minutes, especially for minor incidents.

- 24/7 accessibility: AI-powered chatbots and online platforms provide round-the-clock access to information and support, eliminating the need for customers to wait for business hours. Customers can access their policy documents, manage their accounts, or report claims anytime, anywhere.

- Personalized service: AI-powered analytics can identify individual customer preferences and tailor communication and service offerings accordingly. For example, customers who frequently use specific features or have a history of specific claims might receive personalized recommendations or notifications about relevant updates.

Customer Support Resources

Tesla Insurance, like any insurance provider, recognizes the importance of accessible and comprehensive customer support. They offer a range of resources designed to assist policyholders with inquiries, claims, and general information. These resources aim to provide a seamless and efficient customer experience.

Available Customer Support Resources

Tesla Insurance offers a variety of customer support resources, including:

- FAQs: Tesla Insurance maintains a comprehensive FAQ section on its website, addressing common questions related to policy coverage, claims procedures, billing, and more. This resource serves as a quick and easy reference point for policyholders.

- Online Guides: The company provides detailed online guides that cover various aspects of insurance, from understanding policy terms to navigating the claims process. These guides offer step-by-step instructions and clear explanations, enhancing user comprehension.

- Community Forums: Tesla Insurance encourages community engagement through online forums where policyholders can connect, share experiences, and seek support from fellow users. These forums provide a platform for peer-to-peer interaction and valuable insights.

- Contact Information: Tesla Insurance provides clear and readily accessible contact information, including phone numbers, email addresses, and online forms, for direct communication with customer support representatives.

Quality and Comprehensiveness of Resources

The quality and comprehensiveness of Tesla Insurance’s customer support resources are generally considered to be above average. The FAQs section is well-organized and covers a wide range of topics. The online guides are detailed and user-friendly, providing clear instructions and helpful explanations. The community forums foster a sense of community and offer valuable insights from fellow policyholders.

Table of Customer Support Resources

| Resource | Purpose |

|—|—|

| FAQs | To answer common questions related to policy coverage, claims procedures, billing, and more. |

| Online Guides | To provide detailed information on various aspects of insurance, such as understanding policy terms and navigating the claims process. |

| Community Forums | To connect policyholders, share experiences, and seek support from fellow users. |

| Contact Information | To facilitate direct communication with customer support representatives. |

Customer Service Training and Development

Tesla Insurance, like any successful insurance provider, recognizes the critical role of customer service representatives in building and maintaining customer trust. The company invests heavily in training and development programs to ensure its representatives are equipped with the knowledge, skills, and empathy necessary to deliver exceptional customer experiences.

Training Program Structure and Content

Tesla Insurance’s customer service training programs are designed to be comprehensive and multifaceted, encompassing both technical and soft skills. These programs are typically delivered through a combination of online modules, interactive workshops, and role-playing exercises, ensuring a dynamic and engaging learning experience.

- Product Knowledge: Representatives receive in-depth training on Tesla Insurance products, including coverage options, policy features, and pricing structures. This training equips them to answer customer inquiries accurately and effectively, providing comprehensive and personalized solutions.

- Claims Processing: Representatives are trained on the company’s claims process, from initial reporting to final resolution. They learn how to guide customers through the process, manage expectations, and ensure a smooth and efficient claims experience.

- Technology Proficiency: Tesla Insurance leverages advanced technology platforms for customer service, including its proprietary mobile app and online portal. Representatives undergo rigorous training on these platforms, enabling them to navigate them seamlessly and provide customers with quick and efficient support.

- Communication and Interpersonal Skills: Representatives are trained in active listening, empathy, and effective communication techniques. They learn how to handle challenging situations with tact and professionalism, fostering positive customer interactions.

Ongoing Development Initiatives

Tesla Insurance recognizes that the customer service landscape is constantly evolving. To stay ahead of the curve, the company implements ongoing development initiatives, including:

- Regular Training Updates: Representatives participate in regular training updates to stay abreast of changes in insurance regulations, product updates, and technological advancements.

- Mentorship Programs: Experienced representatives mentor newer team members, providing guidance and support in navigating challenging situations and refining their skills.

- Performance Feedback: Representatives receive regular performance feedback, enabling them to identify areas for improvement and receive constructive guidance to enhance their skills.

Best Practices in Customer Service Training and Development

Tesla Insurance incorporates several best practices in its training programs, including:

- Scenario-Based Learning: Representatives participate in scenario-based training exercises that simulate real-life customer interactions, allowing them to practice their skills in a controlled environment.

- Gamification: Gamification elements are integrated into training modules to make learning more engaging and interactive, fostering a positive learning experience.

- Real-Time Feedback: Representatives receive real-time feedback from trainers and peers during training sessions, enabling them to make immediate adjustments and improve their performance.

- Customer Feedback Integration: Customer feedback is actively collected and analyzed to identify areas for improvement in training programs and ensure they remain relevant and effective.

Future Trends and Innovations

Tesla Insurance, with its innovative approach to the automotive industry, is well-positioned to leverage emerging trends in customer service and enhance the overall customer experience. The company can capitalize on advancements in technology, data analytics, and customer behavior to create a more personalized, efficient, and seamless insurance experience.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the insurance industry by automating tasks, improving risk assessment, and personalizing customer interactions. Tesla Insurance can leverage these technologies to create a more personalized and efficient customer service experience.

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants can handle routine inquiries, provide instant policy information, and guide customers through the claims process. This frees up human agents to focus on more complex issues, enhancing efficiency and reducing wait times.

- Personalized Recommendations and Pricing: AI algorithms can analyze customer data, driving history, and vehicle usage to provide personalized insurance recommendations and pricing. This tailored approach can increase customer satisfaction and loyalty by offering competitive rates and relevant coverage options.

- Fraud Detection and Prevention: AI and ML algorithms can analyze vast amounts of data to identify patterns and anomalies associated with fraudulent claims. This proactive approach can help Tesla Insurance mitigate fraud risk and protect its financial interests.

Predictive Analytics and Risk Management

Predictive analytics leverages historical data and machine learning algorithms to forecast future events and identify potential risks. Tesla Insurance can utilize predictive analytics to improve risk management, optimize pricing, and enhance customer service.

- Proactive Risk Assessment: Predictive models can analyze driving data, vehicle maintenance records, and other relevant factors to identify potential risks associated with individual customers. This allows Tesla Insurance to offer personalized safety recommendations and preventive measures, potentially reducing accidents and claims.

- Dynamic Pricing and Coverage: By analyzing driving behavior and other risk factors, Tesla Insurance can dynamically adjust insurance premiums and coverage based on individual customer needs. This data-driven approach can ensure customers pay only for the coverage they need, promoting fairness and transparency.

- Targeted Customer Communication: Predictive analytics can identify customers who may be at risk of switching providers or filing claims. Tesla Insurance can use this information to proactively reach out to these customers with personalized offers, promotions, or support services, enhancing customer retention and satisfaction.

Case Studies and Examples

Illustrative case studies offer valuable insights into the nuances of Tesla Insurance customer service interactions, showcasing both best practices and areas for potential improvement. By examining real-world examples, we can gain a deeper understanding of how Tesla Insurance navigates common customer scenarios and the impact of its approach on customer satisfaction.

Customer Experience with a Minor Accident

This case study focuses on a customer who experienced a minor fender bender while driving their Tesla. The customer initiated a claim through the Tesla mobile app, submitting photos of the damage and providing a brief description of the incident. The claim was processed efficiently, with the customer receiving an estimated repair cost and a notification of the assigned repair shop within 24 hours. The customer was impressed with the ease and speed of the process, highlighting the app’s user-friendly interface and the transparency of communication throughout the claim process.

Navigating a Complex Repair

In this case, a customer encountered a complex repair situation involving a major component failure in their Tesla. The customer contacted Tesla Insurance through their dedicated phone line, where they were connected with a knowledgeable agent who guided them through the process. The agent worked closely with the customer to ensure proper documentation was gathered and facilitated communication with the authorized repair center. Despite the complexity of the repair, the customer praised the agent’s professionalism, responsiveness, and commitment to resolving the issue.

Resolving a Billing Dispute

This case study involves a customer who experienced a billing discrepancy related to their Tesla Insurance premium. The customer reached out to customer support through email, providing detailed information about the issue. Tesla Insurance responded promptly, acknowledging the error and adjusting the customer’s premium accordingly. The customer expressed satisfaction with the resolution, emphasizing the company’s willingness to address billing issues efficiently and fairly.

Customer Feedback and Improvement

The following table summarizes the key features and lessons learned from these case studies:

| Case Study | Key Features | Lessons Learned |

|---|---|---|

| Minor Accident Claim | Easy claim submission via app, prompt processing, transparent communication | Leverage technology to streamline claim processes and enhance customer experience. |

| Complex Repair | Knowledgeable and responsive agents, efficient communication with repair center | Invest in training and empower agents to effectively manage complex repair situations. |

| Billing Dispute | Prompt response to customer inquiries, proactive resolution of billing errors | Prioritize customer satisfaction by addressing billing issues swiftly and fairly. |

Epilogue

Tesla Insurance represents a significant step for the company into a new realm. By leveraging its technology and understanding of its vehicles, Tesla aims to deliver a more personalized and potentially cost-effective insurance experience. While its customer service channels and claims process appear to be streamlined, ongoing feedback and analysis will be crucial in ensuring long-term customer satisfaction and loyalty. As Tesla continues to refine its insurance offering, the success of its customer service will be a key factor in determining its impact on the broader insurance market.