The insurance deductible, a seemingly simple concept, plays a pivotal role in shaping the financial landscape of risk management. It acts as a crucial bridge between the insured and the insurer, influencing both premium costs and the ultimate burden of covered losses. This exploration delves into the intricacies of insurance deductibles, examining their purpose, factors influencing their amount, and their impact on both personal financial planning and consumer behavior.

From the initial definition of deductibles and their impact on premium costs to the complexities of deductible waivers and their influence on consumer behavior, this guide offers a comprehensive understanding of this essential element of insurance.

Definition of Insurance Deductible

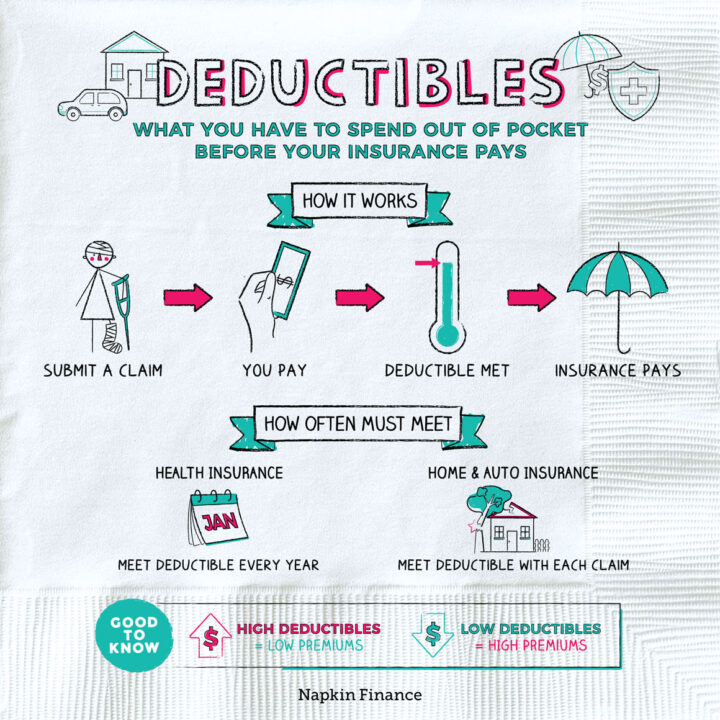

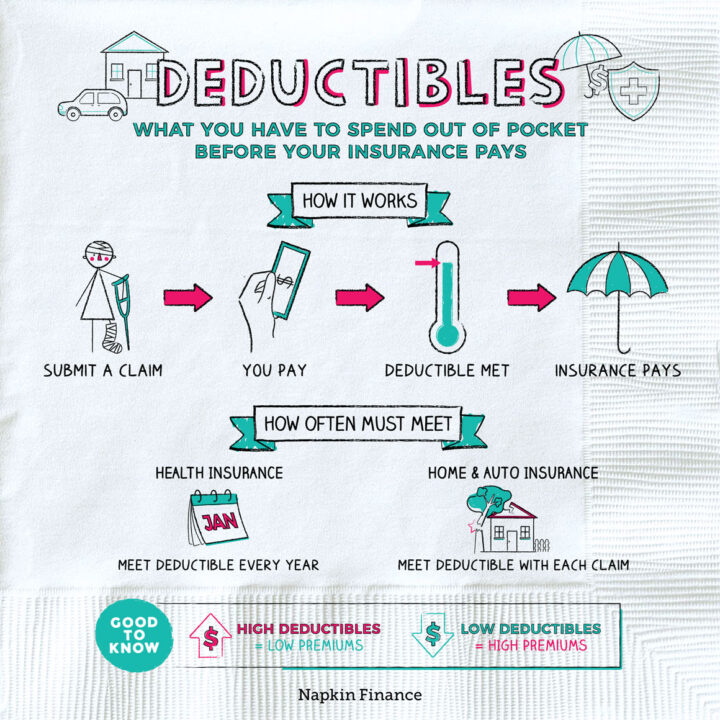

An insurance deductible is a fixed amount of money that you, the policyholder, agree to pay out-of-pocket before your insurance coverage kicks in. Think of it as your share of the cost for covered losses. It’s a common feature in many types of insurance policies, and it plays a significant role in determining your premium costs.

Deductible Impact on Premium Costs

The relationship between deductibles and insurance premiums is inversely proportional. This means that a higher deductible generally translates to a lower premium, and vice versa. This relationship stems from the fundamental concept of risk sharing. When you choose a higher deductible, you’re essentially taking on more financial responsibility for smaller claims, thereby reducing the risk for the insurer. As a result, they can offer you a lower premium.

Higher deductible = Lower premium

Lower deductible = Higher premium

For example, consider two individuals, both seeking car insurance. Person A opts for a $500 deductible, while Person B chooses a $1,000 deductible. Person B, with the higher deductible, is likely to pay a lower premium than Person A. This is because the insurer anticipates fewer claims from Person B, as they will be more inclined to cover smaller repairs themselves due to the higher deductible.

Purpose of Deductibles

Deductibles are a crucial element in insurance policies, playing a vital role in risk sharing between the insured and the insurer. They represent the initial portion of a covered loss that the policyholder is responsible for paying out of pocket before the insurance coverage kicks in. This arrangement serves a multi-faceted purpose, influencing both the cost of insurance and the behavior of policyholders.

Risk Sharing

Deductibles are a mechanism for sharing the risk of potential losses between the insured and the insurer. By requiring the policyholder to absorb a portion of the loss, the insurer can offer lower premiums. This principle works on the premise that policyholders are more likely to take precautions against losses when they know they will bear a financial consequence. The insurer, in turn, can manage its overall risk exposure and offer competitive rates to its customers.

Encouraging Policyholder Precautions

Deductibles incentivize policyholders to take proactive measures to prevent losses. When individuals know they will have to pay a portion of the cost of a claim, they are more likely to be diligent in protecting their assets. This could involve actions like installing security systems, maintaining vehicles regularly, or taking preventative measures against natural disasters. The presence of deductibles fosters a sense of responsibility and encourages individuals to make informed decisions that minimize the likelihood of claims.

Keeping Premiums Affordable

Deductibles contribute to the affordability of insurance premiums by reducing the overall cost of insurance for both the insurer and the policyholder. By sharing the financial burden of losses, insurers can reduce their payouts and offer lower premiums to policyholders. For example, if an insurer has to pay out less due to policyholders absorbing a portion of the losses through deductibles, they can allocate more resources towards other operational costs, potentially resulting in lower premiums for everyone.

Factors Influencing Deductible Amounts

.png/9025a687-d4ba-450f-fa19-12a92c3cb212?imagePreview=1)

Insurance companies carefully consider several factors when determining deductible amounts for their policies. These factors vary depending on the type of insurance, and they directly impact the cost of coverage and the amount the insured individual pays out of pocket in the event of a claim.

Deductible Amounts and Coverage Limits

The deductible amount is directly linked to the coverage limits of the insurance policy. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. This relationship stems from the fundamental principle of risk sharing between the insurer and the insured. A higher deductible indicates that the insured is willing to shoulder a larger portion of the financial burden in the event of a claim, allowing the insurer to offer lower premiums. Conversely, a lower deductible implies the insured prefers to pay higher premiums for the assurance of lower out-of-pocket expenses.

Factors Affecting Deductible Amounts

- Type of Insurance: Deductible amounts vary significantly across different types of insurance. For example, auto insurance deductibles are typically lower than those for homeowners insurance. This difference reflects the relative frequency and severity of claims in each category. Auto accidents are more common, but the average claim amount is generally lower than for home damage.

- Risk Profile of the Insured: Insurance companies assess the risk associated with each insured individual, factoring in factors such as age, driving history, credit score, and location. Individuals with a higher risk profile may be required to pay higher deductibles.

- Coverage Limits: The coverage limits of the policy also influence deductible amounts. Higher coverage limits typically result in higher premiums and may also require higher deductibles. This relationship is driven by the increased potential financial exposure for the insurer.

- Market Competition: Insurance companies constantly adjust their deductible amounts to remain competitive in the market. Factors such as the availability of other insurance providers, pricing strategies, and the overall economic climate influence deductible amounts.

Choosing the Right Deductible

Choosing the right deductible involves finding the sweet spot between the amount you pay out-of-pocket in the event of a claim and the cost of your insurance premium. A higher deductible generally means a lower premium, and vice versa.

Deductible Amount and Premium Cost Trade-off

The relationship between deductible amount and premium cost is inversely proportional. This means that as the deductible amount increases, the premium cost decreases, and vice versa. This trade-off arises because a higher deductible signifies that the insurance company bears less risk, leading to lower premium costs.

Guidelines for Determining Optimal Deductible

Determining the optimal deductible involves considering various factors:

- Financial Situation: Individuals with a strong financial buffer can comfortably afford higher deductibles, resulting in lower premiums. Conversely, those with limited financial resources might prefer lower deductibles, even if it means higher premiums, to avoid significant out-of-pocket expenses in case of a claim.

- Claim History: Individuals with a history of frequent claims might benefit from lower deductibles to minimize out-of-pocket costs. Conversely, those with a clean claim history can consider higher deductibles to lower their premiums.

- Risk Tolerance: Individuals with a high risk tolerance might be willing to accept a higher deductible in exchange for lower premiums. Conversely, those with a low risk tolerance might prefer lower deductibles to ensure they are financially protected in the event of a claim.

- Type of Insurance: The optimal deductible for different types of insurance can vary. For example, a higher deductible might be suitable for auto insurance, while a lower deductible might be preferred for health insurance.

Deductible Options and Associated Costs

The following table compares different deductible options and their associated costs for illustrative purposes:

| Deductible Amount | Premium Cost | Out-of-Pocket Expense (Assuming $5,000 Claim) |

|---|---|---|

| $500 | $1,000 | $500 |

| $1,000 | $900 | $1,000 |

| $2,000 | $800 | $2,000 |

Note: The premium cost and out-of-pocket expense are hypothetical examples and can vary based on factors such as age, location, coverage, and insurance provider.

Deductible Payment Process

After you experience a covered loss, understanding how your insurance deductible works is crucial. Your deductible is the amount you pay out-of-pocket before your insurance policy kicks in to cover the remaining costs. The deductible payment process is straightforward, but it’s essential to know the steps involved.

Deductible Payment Process Steps

The deductible payment process typically involves several key steps:

- Report the Loss: The first step is to notify your insurance company about the loss. This is usually done by phone or online, and you’ll need to provide details about the incident, including the date, time, and location of the loss.

- File a Claim: After reporting the loss, you’ll need to file a formal claim with your insurance company. This often involves completing a claim form, providing additional documentation, and possibly meeting with an insurance adjuster.

- Deductible Payment: Once your claim is approved, you’ll be responsible for paying your deductible. This can be done in various ways, such as by check, credit card, or debit card.

- Insurance Coverage: After you’ve paid your deductible, your insurance company will cover the remaining costs of the covered loss, up to your policy limits.

Insurance Claim Processing and Deductible Application

The process of insurance claim processing and deductible application is crucial to understanding how your deductible affects the overall cost of a claim. Here’s a breakdown of the process:

- Claim Assessment: When you file a claim, your insurance company will assess the validity of the claim and determine if it’s covered under your policy. They will also assess the extent of the damage or loss.

- Deductible Application: If your claim is approved, the insurance company will deduct your deductible from the total cost of the loss.

- Payment: After the deductible is applied, your insurance company will pay the remaining amount to you or the service provider, depending on the nature of the claim.

Impact of Deductibles on Claim Costs

The deductible plays a significant role in the overall cost of a claim. A higher deductible typically results in lower insurance premiums, while a lower deductible usually leads to higher premiums. The deductible is a trade-off between the cost of your premiums and the amount you’ll pay out-of-pocket in the event of a loss.

For example, if you have a $500 deductible and your claim costs $2,000, you would pay $500 out-of-pocket, and your insurance company would cover the remaining $1,500.

Deductible Waivers and Exceptions

Insurance policies may contain provisions that waive or reduce your deductible in specific circumstances. These exceptions are designed to provide financial relief in situations where you might be most vulnerable.

Deductible Waivers

Deductible waivers are provisions in insurance policies that eliminate or reduce the amount you are required to pay out of pocket in certain situations. These waivers are typically triggered by specific events or circumstances.

Here are some common situations where insurance policies may waive or reduce deductibles:

- Natural Disasters: Many insurance policies offer deductible waivers for events like hurricanes, tornadoes, earthquakes, and floods. This helps policyholders recover more quickly from devastating natural disasters.

- Acts of Terrorism: Insurance policies often include provisions to waive deductibles in the event of acts of terrorism. This recognizes the extraordinary circumstances and potential financial hardship associated with such events.

- Government-Declared Emergencies: Some insurance policies may waive deductibles during government-declared emergencies, such as pandemics or public health crises. This helps policyholders access essential medical care or coverage without facing significant financial burdens.

Deductible Exceptions

Deductible exceptions are specific circumstances that exempt policyholders from paying their deductible altogether. These exceptions are usually Artikeld in the insurance policy and are subject to specific conditions.

- Preventive Care: Many health insurance policies waive deductibles for preventive care services, such as annual checkups, vaccinations, and screenings. This encourages individuals to prioritize their health and potentially avoid more expensive medical interventions later.

- Emergency Room Visits: In some cases, health insurance policies may waive deductibles for emergency room visits, particularly if the visit is deemed medically necessary. This helps ensure that individuals receive immediate medical attention without being deterred by high out-of-pocket costs.

- Mental Health Services: Some insurance policies offer deductible waivers for mental health services, recognizing the importance of addressing mental well-being and promoting access to care. This can help individuals overcome barriers to seeking mental health treatment.

Deductibles and Insurance Coverage

Deductibles, while seemingly straightforward, have a significant impact on the overall scope of your insurance coverage. Understanding how deductibles influence the types of losses covered and the limitations they impose is crucial for making informed decisions about your insurance policies.

Deductibles and Coverage Scope

The relationship between deductibles and insurance coverage is inherently intertwined. A higher deductible typically means a lower premium, but it also signifies that you will be responsible for a larger portion of the cost of covered losses. Conversely, a lower deductible leads to higher premiums but less out-of-pocket expenses when a claim is filed.

- Lower Deductibles: With a lower deductible, your insurer will cover a greater percentage of the cost of a covered loss, resulting in a lower out-of-pocket expense for you. However, this comes at the cost of higher premiums.

- Higher Deductibles: Opting for a higher deductible means you’ll pay more out-of-pocket when filing a claim, but your premiums will be lower. This approach is often favored by individuals who are willing to take on more financial risk in exchange for lower insurance costs.

Deductibles and Covered Losses

The type of losses covered by your insurance policy can also be influenced by the deductible amount.

- Comprehensive and Collision Coverage: These types of auto insurance cover damage to your vehicle due to incidents like accidents, theft, vandalism, and natural disasters. With higher deductibles, you might be responsible for covering a greater portion of the repair or replacement costs.

- Health Insurance: In health insurance, deductibles determine the amount you must pay out-of-pocket before your insurance coverage kicks in. Higher deductibles often translate to lower monthly premiums, but you will bear a greater financial burden for medical expenses until the deductible is met.

Limitations of High Deductibles

While higher deductibles can lower premiums, they also introduce potential limitations on your insurance coverage.

- Financial Strain: If you face a significant loss, a high deductible can create a financial burden, especially if you are unable to afford the out-of-pocket expenses.

- Claim Filing Disincentive: High deductibles can discourage individuals from filing claims for smaller losses, even if the damage is covered. This can lead to neglecting necessary repairs or replacements, potentially resulting in further damage or complications down the line.

- Coverage Gaps: In some cases, high deductibles may lead to coverage gaps, where the amount you need to pay out-of-pocket exceeds the value of the loss. This can leave you with significant financial responsibility.

Deductibles and Financial Planning

Deductibles, a fundamental aspect of insurance, can significantly influence personal financial planning. They represent the out-of-pocket expenses you bear before your insurance coverage kicks in. Understanding how deductibles impact your finances is crucial for making informed decisions about your insurance coverage and ensuring you have a robust financial plan.

Impact of Deductibles on Financial Planning

Deductibles directly affect your financial planning by influencing your out-of-pocket expenses in case of an insured event. A higher deductible generally translates to lower insurance premiums, while a lower deductible results in higher premiums. The trade-off between premium cost and deductible amount requires careful consideration based on your financial situation and risk tolerance.

Importance of Emergency Funds for Deductibles

Having sufficient emergency funds is vital to cover potential deductibles. Unexpected events, such as accidents, illnesses, or natural disasters, can lead to substantial costs. An emergency fund acts as a safety net, allowing you to meet these out-of-pocket expenses without jeopardizing your financial stability.

Incorporating Deductibles into Financial Planning Strategies

Incorporating deductibles into your financial planning involves a comprehensive approach:

- Assess Your Risk Tolerance: Determine your willingness to bear financial risks. If you are risk-averse, a lower deductible might be more suitable, even if it means higher premiums. Conversely, if you are comfortable with higher risk, a higher deductible with lower premiums might be preferable.

- Estimate Potential Deductible Costs: Evaluate the potential deductible amounts for your insurance policies, considering the types of events covered and the likelihood of claims. This assessment helps you estimate the potential out-of-pocket expenses you might face.

- Build an Emergency Fund: Aim to accumulate an emergency fund that can cover several months’ worth of living expenses, including potential deductibles. This fund acts as a buffer against unexpected events and helps you avoid debt.

- Review Deductibles Regularly: Periodically review your insurance policies and deductible amounts to ensure they align with your current financial situation and risk tolerance. Changes in income, family size, or risk exposure may necessitate adjustments.

Deductibles and Consumer Behavior

Insurance deductibles play a significant role in shaping consumer behavior, influencing how individuals perceive and manage risk. By understanding the impact of deductibles, consumers can make informed decisions about their insurance coverage and adopt practices that mitigate potential financial losses.

Deductibles and Risk Management

Deductibles act as a financial buffer, encouraging individuals to take greater responsibility for managing their own risks. The higher the deductible, the greater the financial burden a consumer assumes in the event of a claim. This financial incentive motivates individuals to engage in preventive measures to minimize the likelihood of claims. For example, a homeowner with a high deductible for fire damage might invest in fire safety equipment or maintain their property more diligently to reduce the risk of a fire.

Deductibles and Personal Responsibility

Deductibles foster a sense of personal responsibility for safety and security. Knowing that they will bear a portion of the cost in case of an accident, individuals are more likely to take precautions to prevent accidents. This could involve driving more cautiously, taking steps to prevent home burglaries, or being more mindful of their health and safety.

Deductibles and Insurance Purchase Decisions

Deductibles influence consumer choices when purchasing insurance. Individuals often weigh the trade-off between a lower premium with a higher deductible versus a higher premium with a lower deductible. Factors such as their financial situation, risk tolerance, and the likelihood of claims play a role in their decision-making process.

For instance, a young, healthy individual with a limited budget might opt for a higher deductible health insurance plan to lower their monthly premiums. Conversely, a family with a history of health issues might prefer a lower deductible plan, even if it means paying a higher premium, to minimize out-of-pocket expenses in case of medical emergencies.

Deductibles in Different Insurance Types

Deductibles are a common feature in various insurance policies, and their impact can differ significantly depending on the type of insurance. Understanding the nuances of deductibles across different insurance types is crucial for making informed decisions about coverage and financial planning.

Deductibles in Health Insurance

Deductibles in health insurance represent the amount you must pay out-of-pocket before your insurance plan starts covering medical expenses. Higher deductibles typically correspond to lower monthly premiums.

Deductibles are the amount you pay out-of-pocket before your health insurance plan begins to cover medical expenses.

For instance, a $1,000 deductible means you would need to pay the first $1,000 of your medical bills yourself before your health insurance plan kicks in.

- Deductibles are a significant factor in determining the overall cost of health insurance, as they represent a direct out-of-pocket expense for policyholders.

- Understanding the deductible amount and its impact on your financial planning is essential when choosing a health insurance plan.

- Many health insurance plans offer options for different deductible amounts, allowing individuals to tailor their coverage based on their risk tolerance and budget.

Deductibles in Auto Insurance

Deductibles in auto insurance determine the amount you pay out-of-pocket after an accident before your insurance company covers the remaining costs.

Deductibles are the amount you pay out-of-pocket after an accident before your insurance company covers the remaining costs.

A higher deductible typically results in lower monthly premiums.

- For example, if you have a $500 deductible and your car sustains $2,000 worth of damage in an accident, you would pay the first $500 and your insurance company would cover the remaining $1,500.

- Deductibles can be a significant factor in the cost of auto insurance, as they represent a potential out-of-pocket expense for policyholders in the event of an accident.

- Choosing a higher deductible can lower your premiums, but it also means you would need to pay more out-of-pocket in case of an accident.

Deductibles in Homeowner’s Insurance

Deductibles in homeowner’s insurance determine the amount you pay out-of-pocket after a covered event, such as a fire or theft, before your insurance company covers the remaining costs.

Deductibles are the amount you pay out-of-pocket after a covered event before your insurance company covers the remaining costs.

A higher deductible typically translates to lower premiums.

- For instance, if you have a $1,000 deductible and your home suffers $5,000 worth of damage in a fire, you would pay the first $1,000, and your insurance company would cover the remaining $4,000.

- Deductibles are a crucial aspect of homeowner’s insurance, as they represent the amount you would need to pay out-of-pocket in the event of a covered loss.

- Choosing a higher deductible can reduce your monthly premiums, but it also means you would have to pay more out-of-pocket if a covered event occurs.

Deductibles and the Insurance Industry

Deductibles play a crucial role in the insurance industry, serving as a fundamental component of risk management and financial stability. They represent a significant factor influencing insurers’ profitability and the overall dynamics of the insurance market.

Impact of Deductibles on Insurers’ Financial Stability

Deductibles directly impact insurers’ financial stability by influencing their exposure to claims and their ability to manage risk effectively.

- Reduced Claims Costs: Higher deductibles translate into lower claims payouts for insurers, as policyholders bear a larger portion of the financial burden for smaller claims. This reduces insurers’ overall claims expenses, contributing to improved profitability and financial stability.

- Risk Mitigation: Deductibles act as a risk mitigation tool by encouraging policyholders to be more cautious and responsible in their actions. The knowledge that they will have to cover a portion of the cost of a claim incentivizes policyholders to take preventive measures and avoid unnecessary risks, reducing the frequency and severity of claims.

- Enhanced Underwriting: Deductibles enable insurers to underwrite policies more effectively. By offering different deductible options, insurers can tailor policies to the risk profiles of individual policyholders, attracting a wider range of customers while managing their exposure to risk effectively.

Summary

Understanding insurance deductibles is not merely a matter of financial literacy; it’s a key to navigating the often-complex world of risk management. By carefully considering deductible amounts and their implications, individuals can optimize their insurance coverage, minimize financial exposure, and make informed decisions that align with their unique needs and circumstances.